Lab B1: AMM DEX ("Build-your-own-Uniswap" Lab)

Introduction

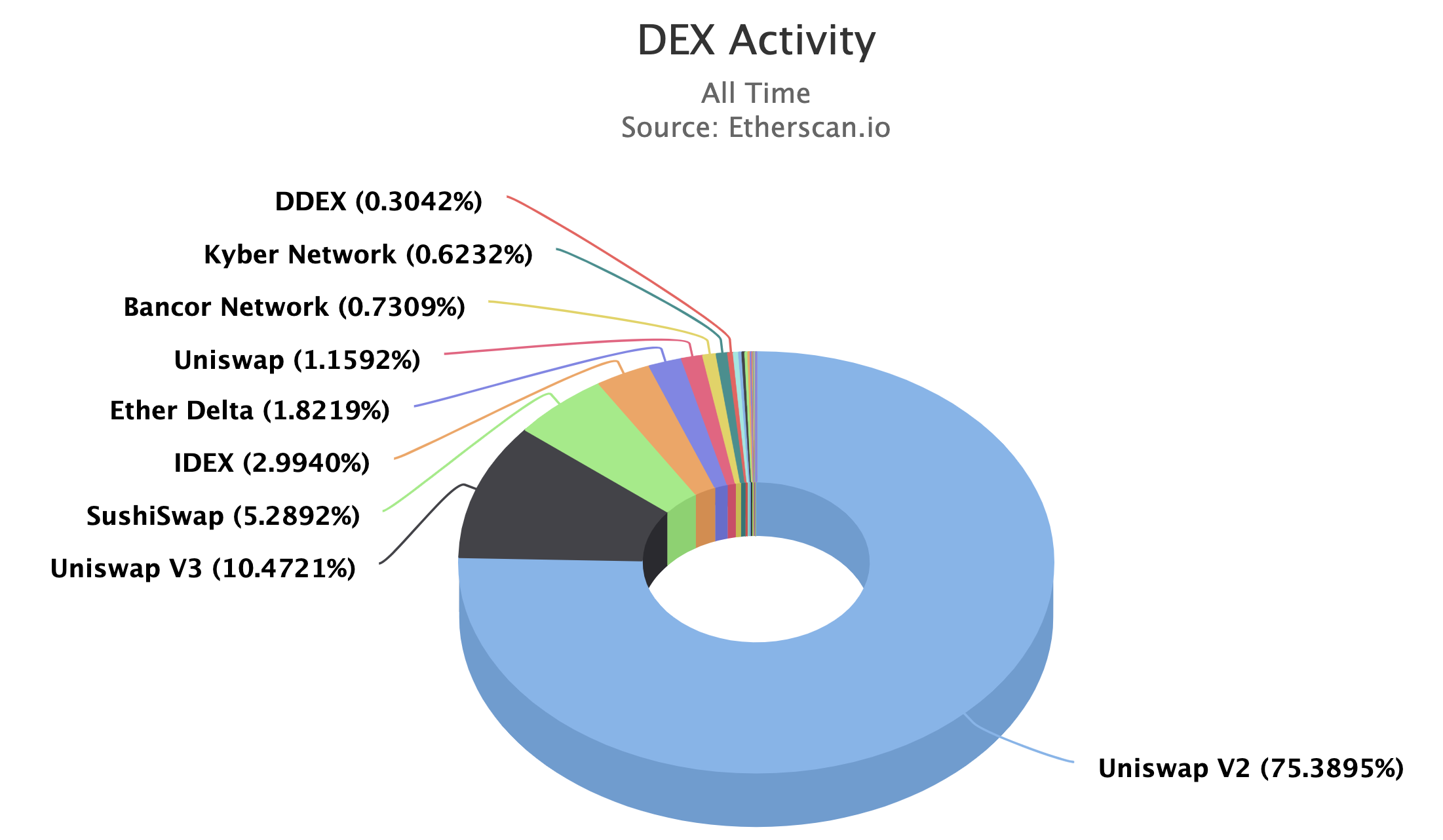

In today's DEX market, Uniswap is the most popular service at all-time. The DEX market distribution on Ethereum can be seen in the following screenshot from https://etherscan.io/stat/dextracker.

In this lab, you will write smart contracts to implement your own version of Uniswap V3. Uniswap adopts the automated market maker (AMM) protocol in which a trader trades directly with a smart-contract intermediary called pool. This is unlike other DEX designs like order books. Besides Uniswap V3, AMM is also adopted in other popular services, including Uniswap V2, Sushiswap, Pancakeswap, etc.

We provide companion slides to introduce more background on AMM: https://www.dropbox.com/s/8749eybqaw67afd/3.DeFi-LabB1.pdf?dl=0

| Tasks | Points | CS student | Finance student |

|---|---|---|---|

| 1 | 10 | Required | Required |

| 2 | 20 | Required | Required |

| 3 | 40 | Required | Required |

| 4 | 40 | Bonus | Bonus |

| 5 | 40 | Required | Bonus |

| 6 | 20 | Required | Bonus |

For your interest, we also provide a challenge exercise 7 on this [page]. Exercise 7 will not be graded and we will not provide solutions as it can be open-ended.

Exercise 1. Execute ERC20 token transfer

The following smart contract implements a very simple token supporting the essential transfer function: transfer(address sender, address recipient, uint256 amount)

pragma solidity >=0.7.0 <0.9.0;

contract BaddToken {

uint _totalSupply = 0; string _symbol;

mapping(address => uint) balances;

constructor(string memory symbol, uint256 initialSupply) {

_symbol = symbol;

_totalSupply = initialSupply;

balances[msg.sender] = _totalSupply;

}

function transfer(address receiver, uint amount) public returns (bool) {

require(amount <= balances[msg.sender]);

balances[msg.sender] = balances[msg.sender] - amount;

balances[receiver] = balances[receiver] + amount;

return true;

}

function balanceOf(address account) public view returns(uint256){

return balances[account];

}}

Your job in this exercise is to deploy the above BaddToken SC and create a Token instance, say TokenX. Then, demonstrate the process that the TokenX issuer transfers 10 TokenX to another account, say Alice, and display each account's balance before/after the transfer.

Exercise 2. Extend BaddToken with approve/transferFrom

function approve(address spender, uint256 amount) external returns (bool);

function transferFrom(address from, address to, uint256 amount) external returns (bool);

function allowance(address owner, address spender) external view returns (uint256);

Your job is to extend the BaddToken with the approve and transferFrom functions defined as above. For example, suppose owner Alice wants to transfer 1 BaddToken to another account Bob, through an intermediary Charlie. Alice first calls approve(Charlie,1) which gives Charlie an allowance of 1 BaddToken. Here, allowance is the amount of the tokens original owner Alice delegate to a third-party spender account Charlie, so that Charlie can spend them on behalf of Alice. Then, Charlie calls the function transferFrom(Alice,Bob,1), through which Bob's balance is credited by 1 BaddToken and Alice's balance is debited by 1 BaddToken.

Deploy the extended BaddToken SC in Remix. We use the following table to test/grade if your deployed token SC is correct. For instance, we may send a sequence of transaction against the instances of your BaddToken: A.approve(C,1), balanceOf(A), allowance(A,C), balanceOf(B), C.transferFrom(A,B,1), balanceOf(B). If your SC is correct, we expect the transaction returns the following: ...,balanceOf(A)=1, allowance(A,C)=1, balanceOf(B)=0,...,balanceOf(B)=1.

| Calls | balanceOf(A) |

balanceOf(B) |

allowance(A,C) |

|---|---|---|---|

| Init state | 1 | 0 | 0 |

A.approve(C,1) |

1 | 0 | 1 |

C.transferFrom(A,B,1) |

0 | 1 | 0 |

Exercise 3. AMM Design with Fixed Rate

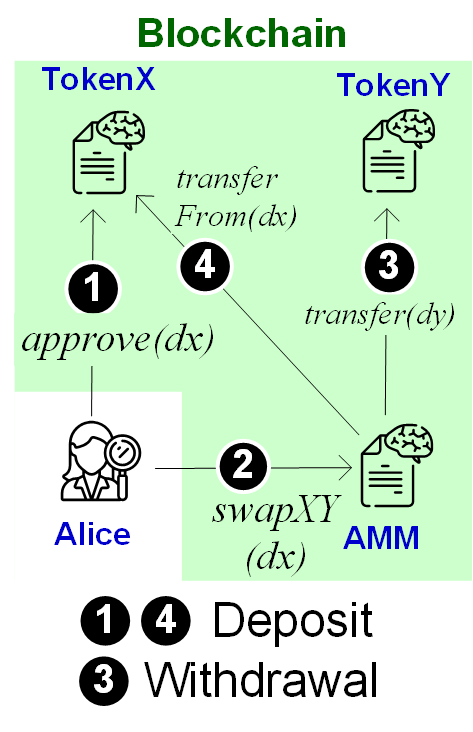

The figure above shows the workflow of the fixed-rate AMM you are going to build. Initially, two token contract accounts i.e., TokenX and TokenY are created by deploying the extended BaddToken you built in Exercise 2.

In Step 1, trader Alice approves $x$ units of TokenX from her account (EOA) to the AMM Pool's contract account (CA). In Step 2, Alice calls the Pool's function swapXY(dx). Upon receiving Alice's transaction, the Pool internally calls TokenY's transfer function to transfer $dy$ units of TokenY to Alice (Step 3). The Pool also internally calls TokenX's transferFrom function to transfer Alice's $dx$ units of TokenX to Bob, spending the allowance (Step 4).

In this exercise, you can consider that $dy/dx = 2$. Implement the AMM smart contract using the following interface.

pragma solidity >=0.7.0 <0.9.0;

contract AMM {

BaddToken tokenX, tokenY;

// _tokenX and _tokenY are contract-addresses running BaddToken SC

constructor(address _tokenX, address _tokenY){

tokenX = BaddToken(_tokenX); tokenY = BaddToken(_tokenY);

}

function swapXY(uint amountX) public payable {

// fill out the following with your code

}

}

You can follow the workflow to execute your code.

- Write and compile a

Poolsmart contract. - Deploy

BaddTokensmart contract twice, respectively to two contract addresses, sayTokenXandTokenY. - Deploy

Poolsmart contract withTokenXandTokenY. -

Execute the smart contracts in two steps:

- call

TokenX'sapprovefunction - call

Pool'sswapXYfunction

- call

-

Hint: You need to ensure your account has enough tokens for both

TokenXandTokenY.

We will test your pool SC using the following test cases. P is the Pool CA, X is TokenX and Y is TokenY.

| Calls | X.balanceOf(A) |

X.balanceOf(P) |

X.allowance(A,P) |

Y.balanceOf(A) |

Y.balanceOf(P) |

|---|---|---|---|---|---|

| Init state | 1 | 0 | 0 | 0 | 2 |

A.approve(P,1) |

1 | 0 | 1 | 0 | 2 |

A.swapXY(1) |

0 | 1 | 0 | 2 | 0 |

Exercise 4. Security Analysis

Now consider a thief Bob who inserts withdrawal (i.e., swapXY call) without making deposit. Here, there are two approaches of committing the theft: First, the thief Bob simply calls swapXY function without calling approve. Demonstrate your solution in Exercise 3 will produce the following test result. You may or may not need update your solution in Exercise 3.

- Note that the test case below means to run the following sequence of function calls:

X.balanceOf(B),X.balanceOf(P),X.allowance(B,P),Y.balanceOf(B),Y.balanceOf(P),B.swapXY(1),X.balanceOf(B),X.balanceOf(P),X.allowance(B,P),Y.balanceOf(B),Y.balanceOf(P). Again,Pis the Pool CA,XisTokenXandYisTokenY.

| Calls | X.balanceOf(B) |

X.balanceOf(P) |

X.allowance(B,P) |

Y.balanceOf(B) |

Y.balanceOf(P) |

|---|---|---|---|---|---|

| Init state | 1 | 0 | 0 | 0 | 2 |

B.swapXY(1) |

1 | 0 | 0 | 0 | 2 |

Second, a thief Bob observes another account say Alice's deposit and sends his withdrawal transaction to be ordered before her withdrawal transaction (an adversarial behavior called frontrunning attacks). Demonstrate your solution in Exercise 3 will produce the following test result (with security against frontrunning). You may or may not need update your solution in Exercise 3.

| Calls | X.balanceOf(A) |

X.balanceOf(B) |

X.balanceOf(P) |

X.allowance(B,P) |

Y.balanceOf(A) |

Y.balanceOf(B) |

Y.balanceOf(P) |

|---|---|---|---|---|---|---|---|

| Init state | 1 | 0 | 0 | 0 | 0 | 0 | 2 |

A.approve(P,1) |

1 | 0 | 0 | 1 | 0 | 0 | 2 |

B.swapXY(1) |

1 | 0 | 0 | 1 | 0 | 0 | 2 |

A.swapXY(1) |

0 | 0 | 1 | 0 | 2 | 0 | 0 |

Exercise 5. Constant-product AMM

Suppose the AMM account owns $x$ units of TokenX and $y$ units of TokenY. The AMM pool can use a function $f(x,y)$ to calculate the exchange rate between TokenX and TokenY on the fly. Specifically, it enforces that function value is constant before and after each token swap, that is,

$$f(x,y)=f(x+dx,y-dy)$$

In this exercise, you will extend your solution in Exercise 3 to implement constant-product AMM, where $f(x,y)=x*y$. Modify your AMM smart contract to support the constant-product invariant $x*y=(x+dx)(y-dy)$.

- Hint: You may want to keep track of token balance $x$ and $y$ in the AMM smart contact by issuing

balanceOfin eachswapXYcall.

We will test your solution using the following test case:

| Calls | X.balanceOf(A) |

X.balanceOf(P) |

X.allowance(A,P) |

Y.balanceOf(A) |

Y.balanceOf(P) |

|---|---|---|---|---|---|

| Init state | 1 | 1 | 0 | 0 | 4 |

A.approve(P,1) |

1 | 1 | 1 | 0 | 4 |

A.swapXY(1) |

0 | 2 | 0 | 2 | 2 |

Exercise 6. Undo approve upon Standalone Deposit

In Exercise 5, consider an Alice who called approve function (the Deposit step) but did not call swapXY (the Withdrawal step). This is possibly due to that Alice changes her mind after the deposit and wants to undo it.

Extend your pool SC from the previous exercises to support undo approve and to revert a trade-in-progress. You may want to implement a function in the AMM pool, say undo_approve(). After Step 1 and calling refund(), Alice will have her original balance in TokenX and zero allowance to the pool. That is (P is the Pool CA):

| Calls | X.balanceOf(A) |

X.balanceOf(P) |

X.allowance(A,P) |

|---|---|---|---|

| Init state | 1 | 0 | 0 |

A.approve(P,1) |

1 | 0 | 1 |

A.undo_approve() |

1 | 0 | 0 |

Deliverable

- For all tasks, you should 1) submit your smart-contract code, and 2) show the screenshot of the program execution.